Troubled mobile operator Etisalat Nigeria has got a new chairman. He is Central Bank of Nigeria (CBN) Deputy Governor Dr. Joseph Nnanna.

In a statement, the firm also announced Mr Boye Olusanya, a former Deputy Managing Director of Celtel Nigeria (now Airtel Nigeria) as its Chief Executive Officer (CEO).

Other board members were listed after a deal between the firm and the consortium of 13 banks that lent the company $1.2b about five years ago.

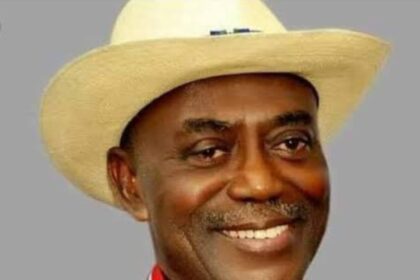

Mr. Boye Olusanya is Managing Director/CEO. He is a former Deputy Chief Executive Officer and Acting Chief Executive Officer, Econet Wireless. When the telco metamorphosed to Celtel Nigeria Limited, Olusanya assumed the role of Deputy Chief Executive Officer and led the business strategy initiative for data services as well as key strategic operational changes.

Olusanya, who replaces Mathew Wilshere, handled high level responsibilities at Dangote Industries Limited where he served as Chief Business Transformation Officer responsible for management of all enterprise-wide projects in the Group.

He was also the CEO at Dancom Technologies Limited with responsibility for managing all the telecom assets and the IT infrastructure.

Sources said Wilshere will still stay around to contribute his wealth of experience to the stability of the telco. He is expected to be around till December when his contract expires.

The Executive Director, Finance, is Mrs. Funke Ighodaro, a former Chief Financial Officer of Tiger Brands Limited, she also held the position of Chief Financial Officer of Primedia (Pty) Ltd, and was Managing Director of a private equity firm, Kagiso Ventures Limited and Executive Director of its parent company, Kagiso Trust Investment Company.

The National Senior Partner, KPMG Professional Services, Nigeria, Mr. Oluseyi Bickersteth, was appointed as Non-Executive Director of the board.

Another Non-Executive Director of the board is Mr. Ken Igbokwe who joined Price Waterhouse in London in 1978 and moved to PwC Nigeria in 1988. He became the Country Business Executive Leader of PwC Nigeria and West Africa and was a member of the PwC Africa Executive Committee.

In a statement yesterday, The Nigerian Communications Commission (NCC) said all the parties involved in the dispute over Etisalat’s indebtedness had come to terms.

This, it said, is to save the company, prevent assets stripping and the jobs of over 4,000 workers.

The NCC’s statement by its Director of Public Affairs, Tony Ojobo, announced that “a smooth transitional process is currently ongoing on mutually agreed terms”.

Though the NCC did not disclose the terms of the agreement, it assured Etisalat’s 20 million subscribers of the integrity of its network across the country.

The statement said: “Following our Press Release of June 20, 2017 on the above, and in response to stakeholder enquiries regarding the current position on Etisalat Nigeria, the Nigerian Communications Commission (NCC) wishes to state as follows:

“The Commission is pleased to note that Etisalat and its creditors have successfully reached an amicable resolution of key issues pertaining to its indebtedness, and that a smooth transitional process is currently ongoing on mutually agreed terms.

“The Commission is confident that the amicable resolutions reached by the parties will further strengthen Etisalat’s capacity to continue to provide services to its over 20million customers and to fulfil its obligations to its other stakeholders as a going concern, regardless of any changes that the parties have agreed to Etisalat’s Ownership, its Board and/or its Executive Management.

“We further wish to assure that as empowered by the Nigerian Communications Act 2003, the Commission will continue to work assiduously with all industry stakeholders to ensure that the Nigerian telecommunications industry remains capable of playing its critical role as a key driver of national socio-economic development. NCC is mindful of the need to sustain the industry’s significant contribution to National GDP, employment and infrastructure roll-out at all times. The Commission’s intervention in the matter was informed by these considerations, and we are pleased at the success of the ongoing process.

“The Commission also wishes to acknowledge the pivotal role of the Central Bank of Nigeria in resolving the matter in a manner that protects the interests of all stakeholders – especially the creditor banks and Etisalat’s over 20million customers”.