The story of Heritage Bank can be likened to the idiom of the old wine in a new bottle, an already existing establishment offered as if it were a new one. Daily Trust Saturday reports.

It is the story of how Societe Generale Bank of Nigeria (SGBN), re-commenced operation on January 29, 2013, but this time as Heritage Bank.

SGBN, founded by the late Dr Olusola Saraki, was arguably one of Nigeria’s biggest banks, with over 140 branches spread across major cities in the country at a time.

The influential Saraki family, now headed by Senator Bukola Saraki, former Senate president and a former governor of Kwara State, would no longer be in dominating control of the bank. …CONTINUE READING

In the resurrected SGBN, International Energy Insurance (IEI) had acquired a major stake, with the Saraki family also retaining a 10 per cent shareholding, but with no principal control.

As of September 2013, the bank’s stock was publicly owned by the following corporate entities and individuals: Heritage Investment Services Limited, 80 per cent; Priority shareholders 9 per cent, and Other minority shareholders, 11 per cent.

In the preceding arrangements, Ifie Sekibo, a trained accountant and member of the Chartered Institute of Bankers and Institute of Petroleum, London, who was then the Executive Vice Chairman of IEI, became the pioneer managing director of the Heritage Bank.

Why CBN revoked, restored SGBN license

The Central Bank of Nigeria (CBN) revoked SGBN’s licence in 2006 over its inability to meet the December 31, 2006, recapitalisation deadline.

The CBN had increased the minimum capital for banks to N25 billion in 2004, and gave them up till the end of 2006, to conclude the consolidation.

However, SGBN was among the 64 banks that couldn’t meet the recapitalisation requirement or seal a merger/acquisition arrangement with any of the 25 banks that sailed through.

However, the owners had gone to court challenging the licence revocation and in June 2008, Justice Binta Murtala Nyako, ruled that the CBN’s decision was “in bad faith, unconstitutional, null and void.”

As part of the resolution moving forward, Heritage Bank was deemed to have met the statutory N10 billion capital base for regional banking.

Mrs Josephine Aligwekwe, Group Head, Corporate Affairs of Heritage Bank, quoted the CBN letter dated December 27, 2012, conveying the commencement approval titled ‘Re: Application for A Commercial Banking Licence with Regional Authorisation’.

The letter was signed by the then CBN Director of Financial Policy and Regulations, Chris Chukwu.

From that point, the immediate task of the new management was undertaking a validation of the account statements of former customers of the moribund SGBN.

Heritage Bank went on to return 100 per cent of existing Societe Generale account holders’ monies to their owners.

Life as a re-born Heritage Bank

Heritage Bank Plc took immediate action after sorting out legacy issues and went on to offer banking and financial services in the country, including in the South West, South East and the North.

As of December 2015, the total asset valuation of the bank was estimated at US$1.7+ billion (N483.4 billion). Its shareholders’ equity was worth at least US$88 million (N25 billion).

In October 2014, Heritage Banking Company Ltd. successfully met the requirements of the Asset Management Corporation of Nigeria (AMCON) and the CBN toward owning 100 per cent shares in Enterprise Bank Ltd.

On January 27, 2015, AMCON officially transferred ownership of Enterprise Bank Ltd. to Heritage Bank Plc

On the back of the acquisition, Heritage Bank Plc expanded to 127 branches and 202 automated banking centres with over 350 ATMs in all states of the federation and the Federal Capital Territory (FCT).

Inside Heritage Bank’s journey to liquidation

According to CBN’s Revocation Order signed by the governor, Olayemi Cardoso, dated June 3, and seen by this reporter, Heritage Bank contravened Section 12 (1) of the Banks and Other Financial Institutions Act (BOFIA) 2020 in five different ways: It has insufficient assets to meet its liabilities; conducted its business in an unsound manner; failed to comply with specific obligations imposed upon it under BOFIA, 2020 and the Central Bank of Nigeria Act as well as rules, regulation, guidelines and directives made under both Acts; is critically undercapitalized with a capital adequacy ratio below the prudential minimum applicable to its license category; and its financial performance and condition constitute a threat to financial stability.

Based on Heritage Bank’s 2021 audited (but qualified) Statement of Accounts and Annual Report, its net interest income (that is interest income less interest expense) was in the negative.

Net interest income measures the profitability of a bank and is a major source of income for a bank. It is the difference between what a bank earns as interest on loans and what the bank pays out to depositors as interest on their deposits.

Heritage was paying out more to its depositors (mostly interbank lenders and CBN) than what it was earning on loans. This is largely because the bank’s non-performing loan (NPL) ratio was as high as 81.2 per cent. In other words, Heritage had too many bad loans in its books and so was not earning enough interest income. Out of every N100 it gave out as a loan, N81.2 was bad and unrecoverable.

In addition, the bank’s operating expenses were also higher than its interest income, and so for the 2021 financial year, the bank recorded a loss of N82.9 billion and an accumulated loss of N459 billion. It was the largest loss recorded by any bank in this country in the last 30 years.

Heritage Bank’s shareholders’ funds were -N230 billion (negative N230 billion). At 81.2 per cent NPL, accumulated losses of N459 billion and Negative Shareholders’ funds of N230 billion, Heritage was a dead bank in the world of the living.

The level of distress was primarily why no other bank was willing to buy Heritage.

A distressed bank is bought for the value it would add to the purchaser despite its ill health. It could be the large branch network; size of customer base or its retail franchise with considerable savings and current account balances.

Diamond Bank was distressed when Access Bank bought it in 2014, but it was an attractive investment because it had a lot of retail customers which Access didn’t have then.

Faces behind scrapped Heritage Bank

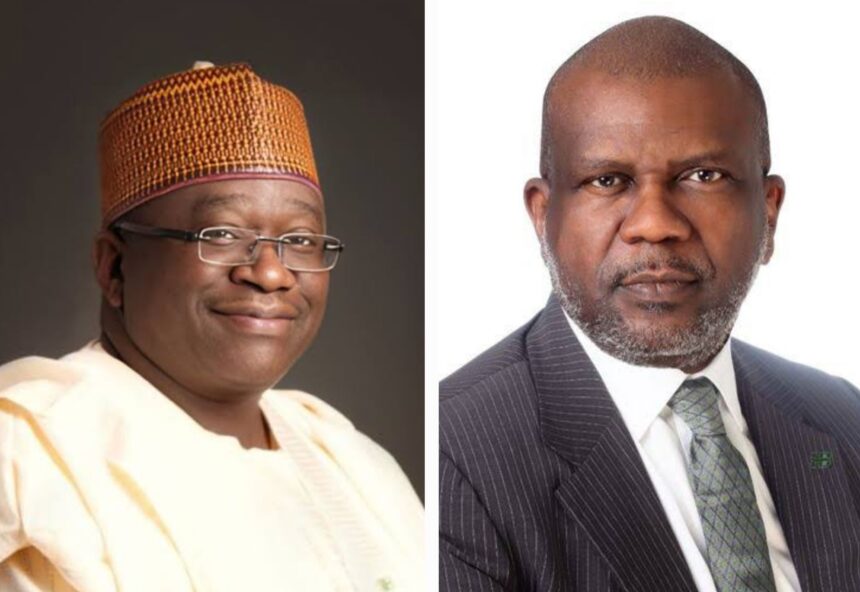

Jani Ibrahim (Chairman)

Jani Ibrahim has extensive experience in the Aviation, Oil and Gas industry. He was a former Managing Director of Nigerian Airways Limited and Stallion Property and Development Company Limited (an NNPC/Unipetrol Joint Venture Company).

He obtained a first-class BSc. degree in Mechanical Engineering from Greenwich University, and is an alumnus of the prestigious Harvard Business School.

Akin George-Taylor (Managing Director/CEO)

Akin George-Taylor is an experienced banker with over two decades working in the banking/financial services sector.

He started his banking career in 1993 with GTBank where he rose to the position of Executive Director in charge of Public Sector Group, Abuja and North Central.

He was also the Managing Director of GTBank in Sierra Leone. In 2012, George-Taylor became the CEO and founder of FAFE International, a financial advisory company offering a wide range of financial and consulting services with a strong focus on corporate, debt and project finance, and wealth management, servicing clients primarily in the Oil and Gas, Power and Real Estate sectors.

Olayemisi Disu (Director)

Mrs Disu has had a successful career with various banks, spanning 25 years, during which she worked in various departments, such as Corporate Banking, Foreign Exchange Treasury, International Operations, Branch Banking, Energy Sector, Telecommunications, Oil and Gas (downstream), Public Sector, Credit & Marketing and Audit and Investigation.

She holds a Bachelor of Science degree (Cum Laude) in Business Administration from the United States International University, Watford, England.

Osepiribo Ben-Willie (Executive Director)

Osepiribo is an accomplished banker with over 25 years of experience. She has been leading business transformation initiatives at various levels within the financial service space. Mrs Ben-Willie was, until the scrapping, the Directorate Head South South, South East & Private Wealth Management Team in Heritage Bank Plc.

She started her banking career as a member of the National Youth Service Corps with the defunct Credite Bank Nigeria Limited in 1991 as a Treasury Officer. She went on to work with Diamond Bank, Zenith Bank and Stanbic IBTC in different capacities.

Adewunmi Ogunsanya (Director)

Ogunsanya graduated with a law degree from the University of Kent in Canterbury UK in 1984 and thereafter proceeded to the Nigerian Law School, where he qualified as a Barrister and Solicitor in 1985.

He obtained his LLM from the prestigious University of Lagos in 1987. Mr Ogunsanya has been in active private practice from 1985 to date

He is the Chairman of Multichoice Nigeria Limited, a multi-billion dollar entertainment conglomerate, owners and operators of brands such as DSTV, Supersports and GoTv. He is also the chairman of Trocadero Group of Companies.

George Oko-Oboh (Executive Director)

He is a distinctive and accomplished financial services professional with over two decades of banking experience functioning in various leading business roles spanning Retail, SME, Commercial, Public Sector, Collections, Funding Advisory and Corporate Negotiations.

He heads the Abuja and North Directorate Business of Heritage Bank Plc where he plays a pivotal role in the business growth and daily operations of all businesses and transactions as it relates to his area of supervision.

He holds two master’s degrees in Business Administration, from Bangor University, UK and the University of Abuja respectively, and a bachelor’s degree in Banking and Finance from Ambrose Ali University, Ekpoma.

– Daily Trust